28+ interest deduction mortgage

Mortgage 1 has helped thousands of. Web In this article well give you an overview of the mortgage interest deduction on your federal taxes.

Tutorials Datadriven2022 Csv At Main Gncll Tutorials Github

However higher limitations 1 million 500000 if.

. Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web Important rules and exceptions. Web What is a mortgages interest rate.

Web How the Mortgage Interest Deduction May Not Help. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

Also you can deduct the points. Discover Helpful Information And Resources On Taxes From AARP. If you bring home 4000 a month after taxes and other deductions.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Choose The Loan That Suits You. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Compare offers from our partners side by side and find the perfect lender for you. Homeowners who are married but filing. Ad Get All The Info You Need To Choose a Mortgage Loan.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and 24400 for married couples filing jointly.

Homeowners spend an average of 284 of their pre-tax income on mortgage payments. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Know Your Mortgage Options.

For the 2021 tax year the standard deduction jumped even higher to 12550 for single filers and 25100 for joint filers. If you are single or married and. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Web 2 days agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. You are able to deduct the mortgage interest on either your primary residence or second house.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Discount Points Deductions. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

If you took out. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Most homeowners can deduct all of their mortgage interest.

The most that could be. Web 1 day agoBest Low-Interest Personal Loans. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

28 Sample Installment Contract Templates In Pdf Ms Word

Home Mortgage Loan Interest Payments Points Deduction

Calameo The Azle News

The Home Mortgage Interest Deduction Lendingtree

Compass Clock Fall Winter 2018 Publication

Property International Magazine Issue 015 Online By Property International Magazine Issuu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Compass Clock Fall Winter 2018 Publication

Mortgage Interest Deduction

Mortgage Interest Deduction What You Need To Know Mortgage Professional

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

May 2010 Association Of Dutch Businessmen

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Mortage Interest Deduction What Is The Mortgage Interest Deduction

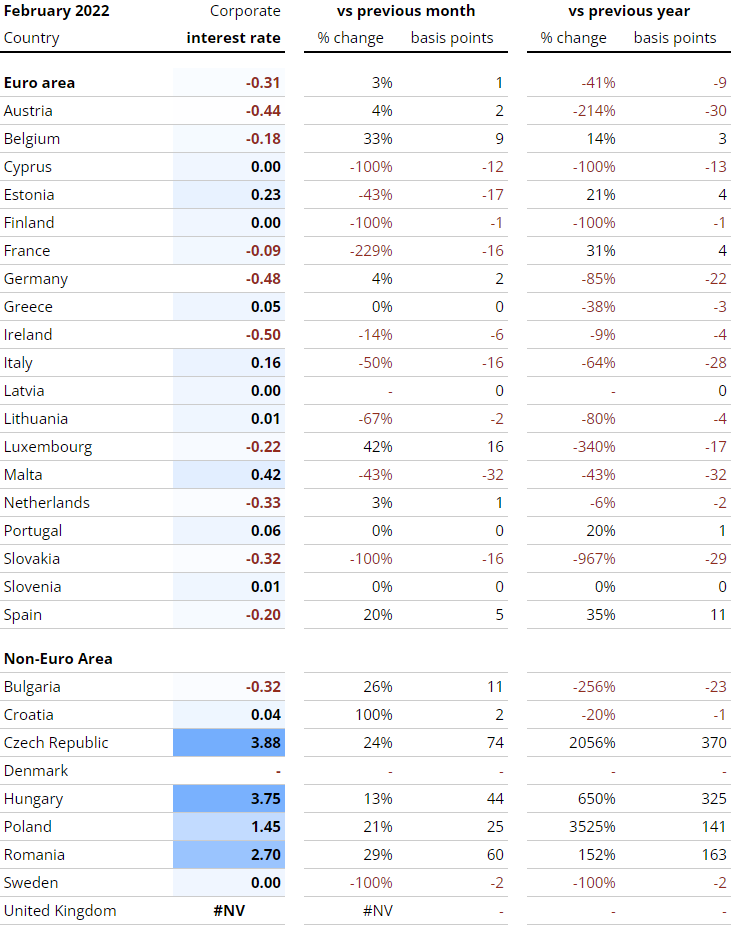

Interest Rates Explained By Raisin

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports